Tax season in Thailand is about to start. As a leading Accounting and Taxation service provider in Thailand, we frequently update you with tax regulations and amendments. Now let us take the opportunity to present the proper understanding of Withholding Tax in Thailand.

A deduction from payments to suppliers offering a service is the withholding tax (or “WHT”). The type of service determines the WHT liability. WHT is also applicable to dividend and interest payments.

According to the Revenue Code of Thailand, a Thai company that pays taxable income to individuals or companies must withhold income tax and send it to the Revenue Department. The following is a description of this procedure’s specific explanation in income tax categories.

Individual Taxpayer

Every individual who is a taxpayer must submit a tax computation to the Revenue Department at the conclusion of the tax year. This tax calculation must be on the total annual income from all sources. The Revenue Department computes the total personal income tax on this basis. It takes into account the previous withholding tax throughout the year and subtracts it from the calculation. It might be possible to make a repayment or an additional payment, depending on the amount of tax deduction.

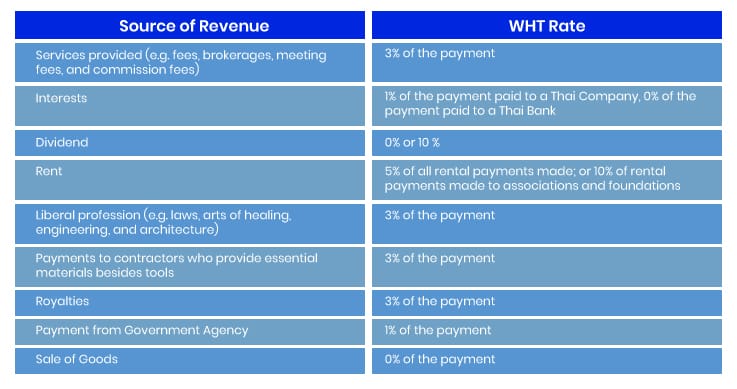

However, an individual taxpayer has the choice as to whether to include dividend or interest income in his taxable income while earning revenue. For your guidance following is the updated slab:

Corporate Taxpayer in Thailand

Except for any Revenue Code mandate, a Thai company making payments to another Thai company may not withhold income tax. However, some income sources for which WHT payment is mandatory are as follows:

Foreign Companies not carrying on Business in Thailand

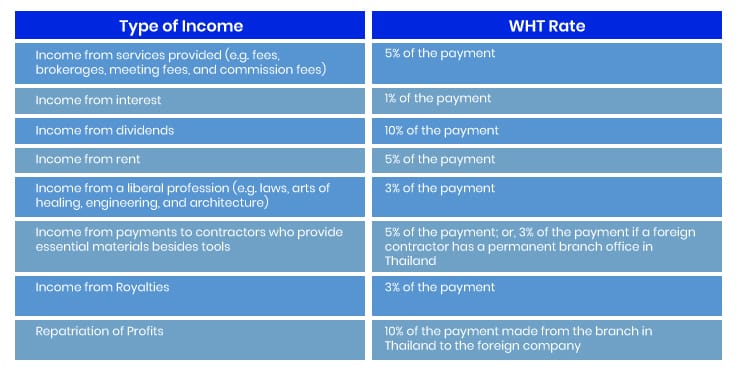

According to Revenue Code Section 40, a foreign corporation that does not conduct business in Thailand but receives money there is normally subject to Thai Income Tax. As a result, those who pay these firms must withhold income tax from their payments. Following are descriptions of significant withholding tax rates by type of income:

However, a double taxation agreement between Thailand and a foreign country may cause the withholding tax rate to be lower.

- The dividend tax is 10%, which is quite low compared to other tax rates. The Thai government’s tax policy explains why this is the case. Dividends won’t be subject to a second round of full taxation because the corporate income tax is already 20%.

- The Thai corporation is often required to withhold tax at a rate of 15% on rental payments if a foreign company rents property to it.

- However, if a foreign firm operates in Thailand by renting property to a Thai company, the Thai company is required to deduct 5% of the rent as tax. The foreign corporation must also pay corporate income tax at a rate of 20% on its rental business’ net profits.

- The withholding tax rate on interest is typically decreased from 15% to 0% under DTAs (for instance, between Thailand and Germany) if the lender is a (German) bank. If a German business sells stock in a Thai company, the capital gains tax is likewise cut to 0%.

Foreign Companies carrying on Business in Thailand

Thai Income Tax (Revenue Code Sec. 40) is generally applicable to foreign firms conducting business in Thailand (by establishing a branch office, employment, representation, or go-between in Thailand and deriving income there). As a result, payers to such companies have to withhold income tax on a mandate. Following are descriptions of significant withholding tax rates by type of income:

Departmental Instruction No. Paw 8/2528 states that a foreign contractor can own a Thai permanent branch office if he/she/they:

- Owns an office in Thailand, or

- Carries on other business in Thailand besides engaging in contract works, like, the purchase and sale of goods, or

- Has(ve) a provident fund set up for the benefit of his employees in Thailand.

The provident fund is typically a voluntary fund contribution by the employees and the employer. This is to encourage savings for the employees. Therefore, terminated or retired employees will have a subsistence fund without relying on the state’s welfare system or their families. At least one employer and one employee can create the provident fund. According to the law, a body that is neither the employee’s employer nor the fund itself must handle the fund. Contribution is from the employee’s paycheck at a rate of not less than 2% but not more than 15%. Employer contributions are not less than the employee’s contribution but not more than 15% of wages.

Furthermore, international businesses must pay corporate income tax in Thailand. The tax rate is 20% of their net profit from the business. However, the tax withheld is applicable as a credit against other taxes.

May you have any other inquiries or seek further clarification, book your consultation with us! Email us your query at officer@konradlegal.com.